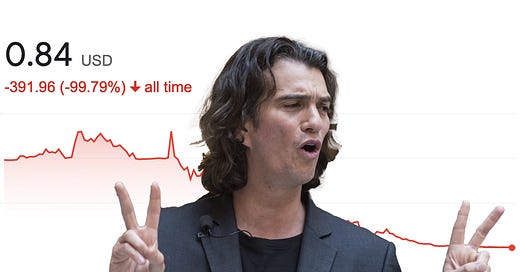

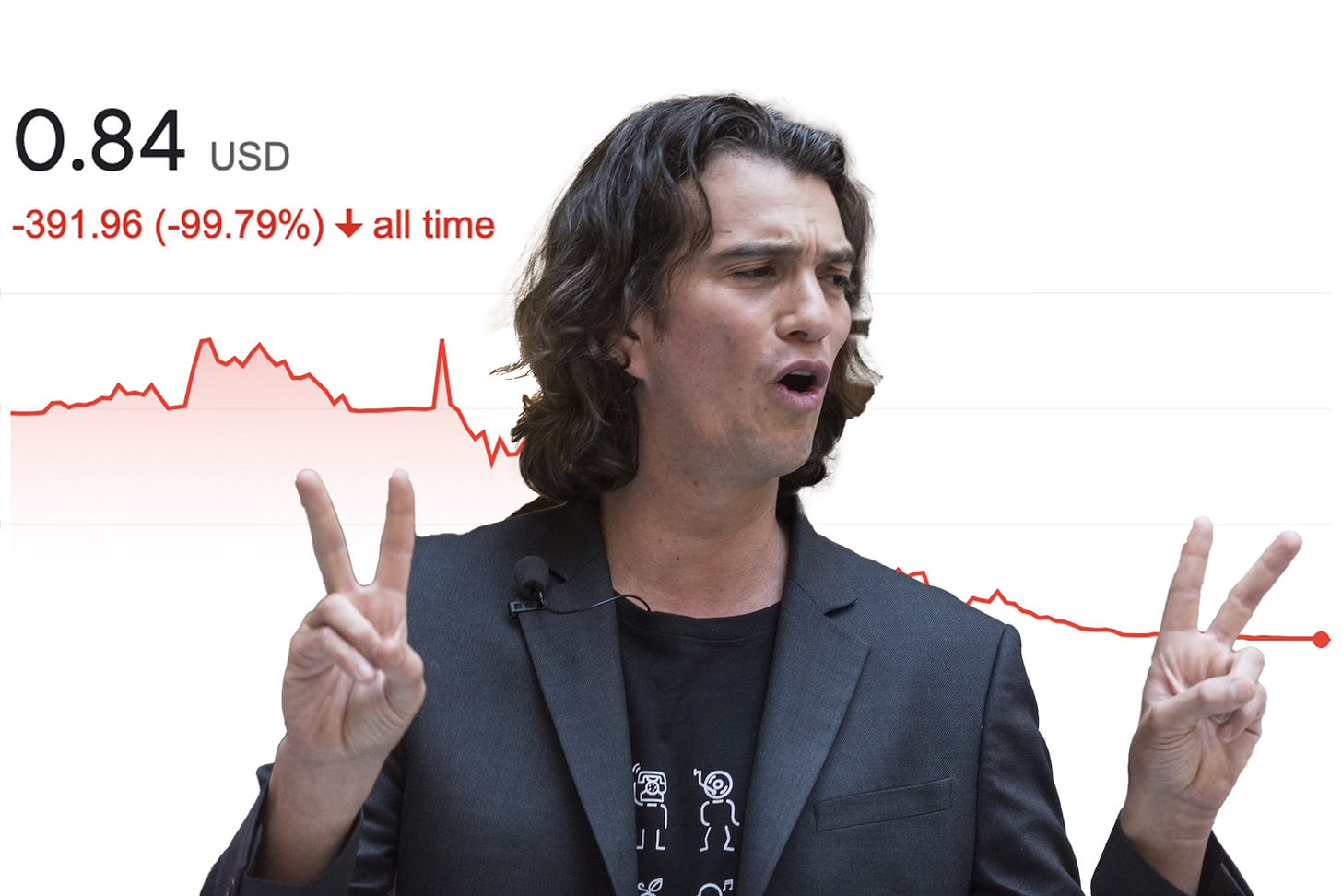

At its peak, WeWork was once valued at $47 billion, making it one of the most valuable tech companies (honestly, who were they kidding) in the world. It has since endured a staggering 99.9% decline, left with a meager market cap of less than $50m. The stock price, which hit an ATH of $520 in October 2021, closed at $0.84 on Friday.

And now, it finally happened. Only 8 months on from a multibillion-dollar rescue package, WeWork announced yesterday that the company was filing for bankruptcy. Or, as they put it, “Strategic action to significantly strengthen balance sheet and further streamline real estate footprint.” Adam Neumann would have been proud of that one.

It marks yet another low point in a remarkable fall from grace. The filing revealed a few details that highlight the extent of the troubles facing WeWork, most notably, the 18.6 billion dollars it listed in debts. It also cited $2.9 billion in long-term debts, which have been crippling the company, and even 100 million dollars in unpaid rent. Numbers that large are hard to pay off when your business doesn’t make profits. In the 13 years WeWork has been operational, it has had one month of profitability, which came last December (and that was adjusted earnings before interest, tax, depreciation and amortization.)

Bankruptcy was the only option left on the table.

Of course, Adam Neumann felt compelled to throw in his two cents, the man who helmed the downfall and pocketed over a billion dollars in return. While his credentials as a CEO should be questioned — if anything, he should be facing criminal charges — it’s clear his ability to extract personal wealth is not in doubt. In a statement released yesterday, he said: “It has been challenging for me to watch from the sidelines since 2019 as WeWork has failed to take advantage of a product that is more relevant today than ever before. I believe that, with the right strategy and team, a reorganization will enable WeWork to emerge successfully.” To me, that reads, “if they had just stuck with me, put up with my reckless spending and copious amounts of tequila shots, and believed in the ‘energy of We,’ I would have made the company a success.”

It’s good to see the messiah complex is still as strong as ever.

It’s not just Neumann, though. WeWork itself remains positive about its future, though that future is likely a far cry in scale from the vision Neumann once held. David Tolley, the current CEO of WeWork, said, “WeWork has a strong foundation, a dynamic business, and a bright future.” He also assured WeWork will “remain committed to investing in our products, services, and world-class team of employees to support our community.”

It may well remain open. That’s partly why the company has entered into bankruptcy. It also presents WeWork an opportunity to try and wriggle out of leases or, at the very least, change terms and restructure its debts. As part of the filing, WeWork will request the ability to reject the leases of certain, largely non-operational, locations.

But even if the company restructures, even if it manages to limp along, it won’t solve the biggest problem — WeWork’s business model isn’t working.

The landscape is far more competitive now than when Neumann first arrived, offering landlords of empty units an easy way out after the financial crash. The company has no USP to differentiate itself from its rivals. It has lost its charismatic, if entirely deluded, poster boy, who drove the wild ambitions of the company and had VCs frothing at the mouth to get a piece of the action. And even on that front, there’s been significant pullback as VCs fret over the current economic landscape and look for safer havens to throw their cash into.

If WeWork can get the debt noose off its neck, the company could have a future. But it will exist as a smaller, slightly profitable co-working space that offers everything that every other co-working space offers, leaving tenants to choose their space based on costs, letting terms, and brand name — not whether it has a wave pool. If it fails to recover, it will leave a trail of carnage in its wake.

As I wrote in WeOver,

this tragic tale leaves a trail of losers in its wake. Who exactly? Well, almost everyone else: employees, shareholders, landlords, vendors, creatives looking for co-working spaces, and, of course, ping-pong table suppliers, wave pool machine manufacturers and kombucha makers.

As always, we can only hope that lessons are learned from the sage. VC greed. Untethered founders pushed to grow without guardrails. Business fundamentals pushed aside for growth metrics and “too big to fail.” But, as always, we can expect that anything worth learning will be ignored. We need only look at Sam Bankman-Fried and the collapse of FTX as an even more recent example of founders on the loose and the potential consequences of that.

The cycle will never end.

Adam Neumann created WeWork to elevate the world’s consciousness. Instead, WeWork only inflated its valuation, and Neumann simultaneously pulled off the biggest destruction and heist of wealth we’ve seen in recent times.

I NEVER understood the hype around WeWork. Kind of amazing to even make it this far with just office space from a brand awareness perspective, but to me it was clear from the beginning that the overall concept would fail. I am surprised they managed to stay "afloat" for this long.