NFTs Are Monkey Business

Somebody get those apes some more slurp juice!

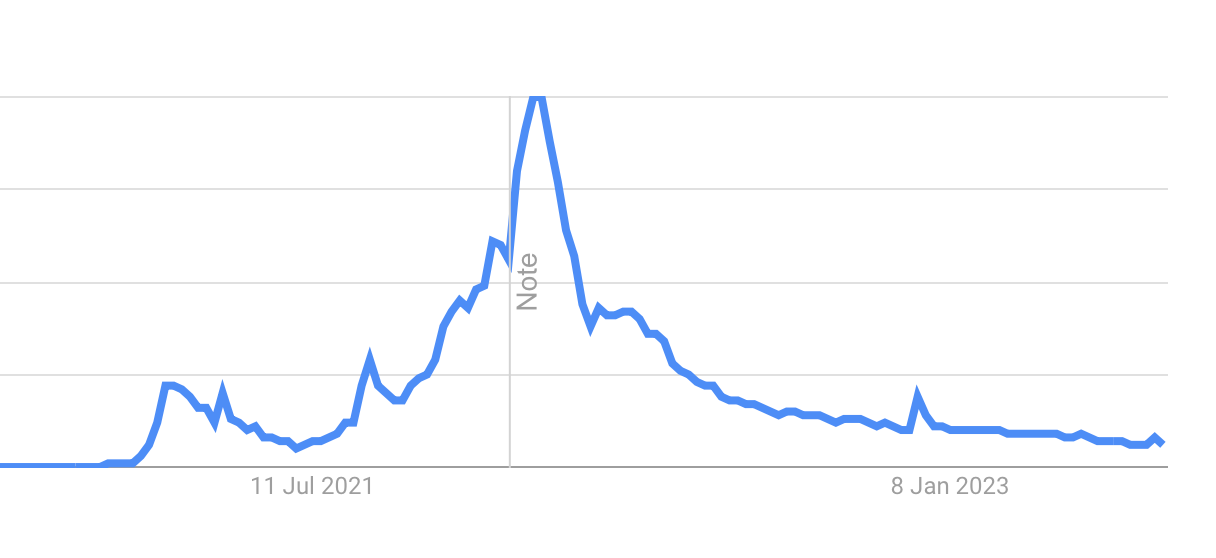

I think that’s still a thing, right? I’d have to admit I’m guessing because, over the last few months, the discourse around NFTs has gone pretty quiet. And for good reason — NFT prices have hit the floor. It’s in stark contrast to the wildly overhyped market that sent the prices of JPEG monkeys and pixelated CryptoPunks into the millions and had creators (and grifters) touting the technology as the future.

An excellent indicator of the health of the NFT marketplace is to ignore the hundreds (if not thousands) of shameless attempts to cash in on the hype. If you need proof of that, check out Web3 Is Going Great, a site that keeps a running tally of scams, most of which are NFT projects. The current total? $63 billion.

Instead, it’s best to study the Blue Chip NFTs, the few projects that held value and *shock* actually built communities as promised. Those Blue Chips are CryptoPunks, Bored Apes, Azuki, Mutant Apes, Clone X and Doodles.

And those chips are down badly.

The flagship project, Bored Ape Yacht Club, saw its price floor hit its lowest point in 20 months. The lowest purchase price for one of these incredible pieces of artwork was about $52,000 as of last Sunday. Only a month ago, that price was almost double. The collection is down 88% since April 2022. Azuki dipped 59% in the past week alone. The wider NFT market has fallen 38% quarter-over-quarter, dropping under $3 billion. It’s bad news everywhere the bag holders look.

What’s caused the latest dip? One of the main factors is liquidation. Bear with me here. Basically, NFT holders were using lending protocols like BendDAO, or the one baked into Blur, the largest marketplace, to negotiate NFT-backed loans. Yes, people were getting loans based on the value of JPEGs. An asset, the price of which is driven solely by FOMO, which offers almost no utility whatsoever, being used to get lines of credit. What could go wrong? The problem with this strategy is that when prices sink, and the market gets turbulent, the value of those NFTs plummets. That leaves NFT owners over-leveraged, meaning they can't repay their loans or face forced sell-offs on certain platforms where liquidation occurs. Last weekend, there were 1,200 liquidations in NFT loans. The normal volume of liquidations per day is ~10-15.

The issue impacts an already-suffering market. For most of the year, the graphs have all ticked downward. Even the surprising surge in March was pumped by wash trading. Now, confidence is low. The pool of buyers is drying up, with daily traders dropping nearly 60% in the last 3 months. The public discourse has moved on to other shiny things like generative AI, meaning it’s going to be near impossible to drum up the levels of hype and FOMO needed to drive the market back to anywhere near its heyday.

I’ve said it from day one, but this iteration of the NFT was destined to be a failure. When it exploded in popularity, it was a perfect storm of conditions; lockdowns keeping us at home, stimulus checks filling our wallets, Wall Street Bets turning the public toward less conventional investments, the Metaverse was going to change the world and cryptocurrency — the currency used to buy and exchange NFTs — was booming. But then the dominos started to fall. Lockdowns ended. Stimulus checks ended, replaced with the threat of recession. Wall Street Bets had its laugh, but actual Wall Street won in the end. Cryptocurrency suffered a huge crash. Despite billions of dollars invested, the Metaverse has failed to materialize, meaning the digital landscape that might have offered NFTs some form of utility doesn't exist. It’s now a perfect storm for collapse. As I’ve written time and time again, what the technology needed wasn’t more collections, or brands making anything and everything an NFT because reasons; it needed real, tangible use cases that the general public could both understand and get on board with, and they needed to appear when NFTs were peaking. Instead, we got lots of shouting, bold claims, and scams. In the end, nothing substantial ever emerged.

The JPEGs are as good as dead. And it’s about time. But from the pixelated ashes is the chance for something meaningful to arise. As the hype cycle ends, we enter the Trough of Disillusionment. Here only the truly dedicated builders (and a few of the downright deluded) remain, moving underground to keep on building. The technology finally has a chance to redefine itself and how it fits into society. The creators have an opportunity to stop chasing money and clout and instead think about the problems it can solve and the solutions it can provide (so far, it’s been vice versa).

And we can only hope those still ‘hodling’ their overpriced JPEG monkeys really did buy them to “appreciate the art.”

Because when it’s worth 99% less than when you bought it, what other comfort do you have?