I'm Tired of the "Next Big Thing"

Crypto.

NFTs.

Metaverse.

Web3/Web5.

GenAI.

Technology has been moving at breakneck speed for some time now, but the last few years have seen the tech industry burn through a frankly ridiculous amount of the "next big thing."

Those trying to cash in on the latest trend — the grifters — have been pivoting so fast they must be suffering whiplash.

I'm tired of it all. I'm tired of being told these game-changing concepts are going to transform my life, only for them to fade out with nothing more than a whimper. I'm tired of our tech overlords trying to force-feed me my future. I'm tired of the tech industry pivoting every 25 seconds to the new shiny object in the hopes of juicing their stock price. I'm tired of everything being about shareholder value at the expense of customer value.

So, I thought it would be cathartic to take a trip down memory lane at some of the more recent "next big things" and how they flattered to deceive. As you’ll see, we’ve lived through some shit.

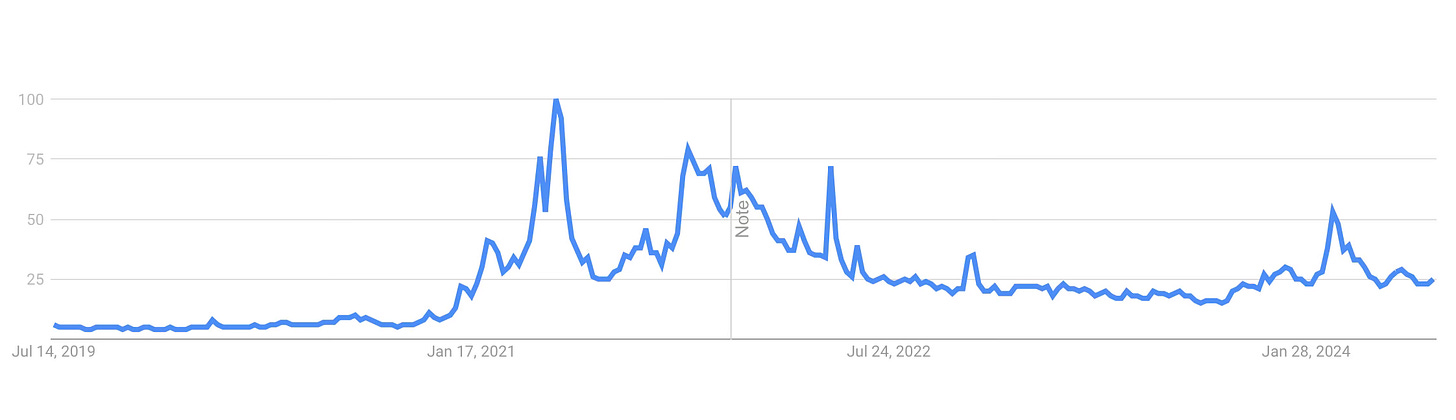

Crypto misses the moon

Fuelled by the pandemic lockdowns and stimulus checks, cryptocurrency endured its biggest bull run yet in late 2021, touching highs of $67,567.

It caused quite a frenzy. Crypto projects popped up everywhere, and crazed investors couldn't pump their money in fast enough. It's going to the moon, rejoiced the hodlers and diamond hands. The consensus was you were an absolute idiot for thinking otherwise.

But it didn't make it to the moon. The rocket ship barely left orbit before turning back towards planet Earth and crash-landing — and the repercussions were felt far and wide. The price drop had severe knock-on effects, most notably the collapse of crypto exchanges like FTX, which left billions of dollars up in smoke and shattered what little trust was left in the industry to self-regulate itself.

The so-called Crypto Winter was looking more like a Crypto Ice Age. Many who pumped the coins had gone silent. Laser eyes were swiftly removed from Twitter profiles. Elon Musk stopped shouting about Dogecoin (read: price pumping).

Was it already over? Not quite.

This year, the price randomly bounced back to a new ATH before dropping off a little. What does that prove? Nothing really. It was wasn’t because of fundamentals; it was just another round of hype. Crypto's main utility is still speculative gambling, and as such, there will continue to be highs and lows until the point — the big if — it finds universal use cases.

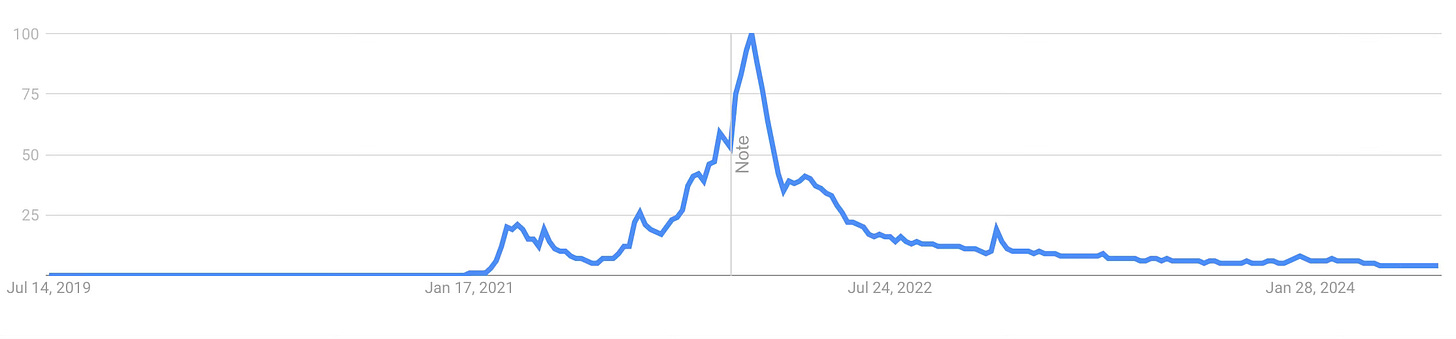

Bored of the apes

The landscape of the online world was altered forever when Beeple's 'Everydays — The First 5000 Days' digital artwork sold at a first-of-its-kind auction for $69,346,250 in March 2021. A few months later, NFT mania exploded. At its peak between August and November that year, the number of NFT sale transactions frequently topped 200,000 per day. In January 2022, sales reached an insane high of $12.6 billion. One guy even burned a $10 million Frida Kahlo artwork because he was convinced that it would be worth more in the Metaverse.

Jokes on him — only 12 months later, sales had dropped 99%.

Since then, the decline has continued. Aside from a few outliers, most projects have proved to be nothing but expensive status symbols that have made a handful of people filthy rich through either shrewd timing or the less-than-savory tactics of scamming or rug-pulling. A site called Web3 is going great has been tracking crypto and NFT scams . The current figure is over $74. billion(!).

As the market continues to plummet, it’s become clear that it was a self-fulfilling ecosystem that has stopped fulfilling itself. With the penny dropping, it's been slowly falling apart; over 95% of NFT projects are now thought to be worthless. This is a breathtaking fall for assets that reached billions in trading volume during the frenzied bull market in 2021/22.

As I've written repeatedly, the technology didn't need more collections or brands making anything and everything an NFT; it needed real, tangible use cases that the general public could both understand and get on board with, and they needed to appear when NFTs were peaking.

Instead, we got bold claims and scams. In the end, nothing substantial ever emerged.

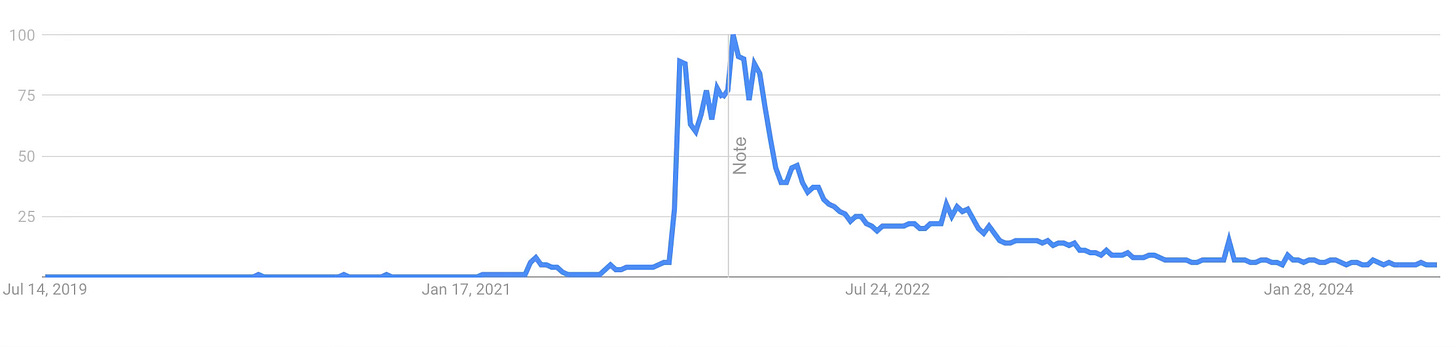

The Metaverse

Where to even begin with this one? When Mark Zuckerberg announced that Facebook was now Meta and the focus was switching to building the Metaverse, he sold it as the future. But the best we've seen from Meta is a second-grade Wii avatar standing in front of a pixelated Eiffel Tower.

Meta has burned well over $20 billion to create a soulless, legless, empty and barely functioning "world." To get anywhere near the vision he shared when he announced the pivot would cost an unthinkable amount of time, money and resources. With the lack of adoption and interest, investors got cold feet — and Zuckerberg has quietly moved on to save his company.

Meta aside, the wider concept of The Metaverse is facing a potentially insurmountable problem: user expectation versus the reality that they can deliver at a mass scale. It's one thing to create an engaging workplace experience with 20 employees roaming around an office. It's another thing to build the infrastructure needed to get the entire internet-ready-population interacting in a world that's so mind-blowingly realistic, exciting and stimulating that we want to reduce our time spent in reality — away from real life — to instead sit in an empty room with a headset on.

The Metaverse has just been another flashy buzzword used to suck up VC money.

Web3 < Web5 < Web6

When pressed for use cases of both crypto and NFTs, many cited Web3 as the foundation for the new digital future. It was touted as a decentralized internet, where crypto would be the currency, NFTs would form our digital goods, and the Blockchain would tie everything together and keep it traceable and accountable. (I should have added the Blockchain to this list — remember when VCs were frothing at the mouth to invest in any company that added blockchain technology to its pitch deck.)

But, again, nothing significant happened. Instead of captivating examples of the future, Web3's image was tarnished as it became the home for monkey profile pictures and shitcoins while failing to become decentralized. Ironically, with the influx of investor money, Web3 was the opposite of decentralized; the VCs controlled the whole concept.

And so, as quickly as it was born, people started to move on from Web3. Jack Dorsey announced the next vision of the internet — Web5. The Web5 vision would be permissionless and open without third-party validators and tokens. As to what that means, your guess is as good as mine. It's about identity. Ownership. Blockchains. Bitcoin. But it's different — or entirely the same.

Whatever it is, they better hurry up. Snoop Dogg announced he was building Web6.

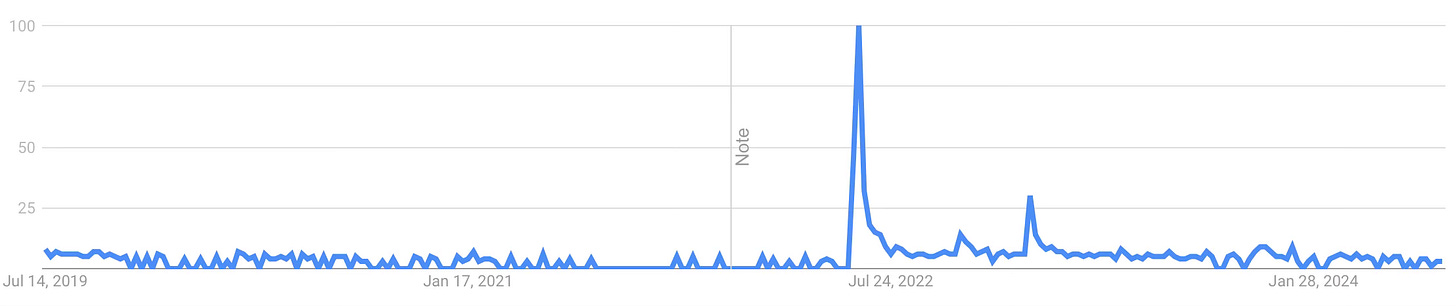

The A.I. grift shift

The metaphorical ink on every VC pitch, company mission statement and creator bio hadn't even dried before everyone was scrambling to find and replace every mention of Web3 with something buzzier.

Enter AI. First, it disrupted the art world with a mixed reception. But then came ChatGPT , which made an enormous splash, and the grift shift went into overdrive.

Since then, we've seen AI stuffing on an industry-wide scale. It's been added to everything and anything, whether it was needed or not. In most cases, it's made products and services worse. It's been stuffed into social platforms, into search platforms, and into every piece of software on the planet. What have we got to show for it so far? Image generators, video generators and chatbots pushing out mediocre content, de-leveling the marketplace and causing divisions to appear in the creative community. Yet, grifters like Sam Altman continue to walk about like they’ve earned some kind of godlike status, shouting about AGI and how he feels entitled to use most of the world's money to build more servers.

AI has shades of all the promises mentioned above in that it found its moment in the spotlight, and it had to capitalize on it before everyone stopped caring — or, in GenAI's case, started to push back. It hasn't. We're seeing progress slow between LLM releases, usage drop, a lack of broader use cases, and people beginning to wise up to the potential dangers and drawbacks of the technology. There are even murmurings that this may be as good as it gets, with future LLMs running out of data to train on. (You know, that data they stole from us).

Like every new hotshot technology, most of this AI stuff will be gone soon enough. Why? Because they are not solving real, tangible problems — they are only trying to capitalize on the trend while it's still hot, for the purpose of making money and keeping shareholders happy.

That's not revolutionary; that's predatory.

Before you know it, we'll have moved on to whatever the next fad is (any predictions are welcome). The creators will jump ship. The VCs will pretend they weren't dumb enough to fall for another false dawn and throw their money at something else.

And the “next big thing” cycle will repeat.

Again.

And again.

I’m so tired of it.

My God, the burning the Frieda Kahlo thing - I hadn't heard about that. It's criminal. NFTs were such an absolute scam from the get-go. To try to build rarity and exclusivity into a technology the very nature of which was the ability to copy and duplicate things so that they are NOT rare or exclusive? It's insane - or, as I said, a scam. Another very interesting piece, Stephen.

My predication for the next big thing? Timeshare virtual appartments! On Mars! For Robots!

One of the interesting things in all this, I think, is how predictable these cycles are even with little understanding of the tech. And I don't think it's because we've simply learned from experience to distrust the hype but rather because there are social dynamics at work that just don't look how they should if people were producing revolutionary new technology.

Speaking from inside the AI industry, I think we have an enormous amount to prove and I would love to have a part in something radically new. But if people were honest about the scale of the challenge, they would say: we're trying to do something no one has done before, so there's an extremely high chance of failure due to misunderstanding the problem or failing to invent what's needed to solve it, and we should build awareness of this into development. I see no such self-awareness or humility, which I think mostly suggests that people are either delusional or insincere.